I know this is going to be hard to believe, but I’m not always right.

Two weeks ago I gave myself a pat on the back because my speculation about the eventual return of the Amex Platinum airline gift card trick ended up being correct (see “It Lives! Amex Platinum Reimbursements For Gift Cards Lives!“).

But when you play Devil’s Advocate and take on the role of arguing against the Conventional Wisdom, it’s inevitable that you’ll whiff on a few. Sometimes I blow one so badly that I might as well be the Ptolemy of points and miles.

So given that I spent a week tooting my own horn, it seems only fair to also review a recent post I wrote in which it’s now become painfully clear that I was wrong. Totally and utterly wrong.

Let’s go to the videotape.

Last February the news broke that Hyatt was offering a 20% rebate on point redemptions through July 31st to anyone who held the Chase Hyatt Visa card. Unsurprisingly, the Conventional Wisdom was that this was a terrific opportunity to apply for a Chase Hyatt Visa.

Of course, I saw the situation somewhat differently, explaining with great authority “Why You Shouldn’t Get a Hyatt Visa for the 20% Rebate.” My argument was that it would take redeeming such a significant number of points within the 6 month timeframe that it was unlikely to be worth an extra credit inquiry to acquire the card unless you already had one.

At the same time I noted that this was a situation of “do as I say, not as I do” because I was personally doing exactly the opposite of what I argued and getting a Hyatt Visa card. I’d been meaning to get the card anyway for its two free nights at any Hyatt and $50 statement credit, and since I did have several Hyatt stays coming up, I saw it as icing on the cake for a card I had planned to get anyway.

But how did I end up doing?

I figured if I was lucky I might be able to pick up an extra $200 worth of points via the rebate, which would make the application worth the credit inquiry. Using the official Travel Codex valuation of Hyatt points at 1.5 cents apiece, that would mean I’d need to get roughly 13,000 points in rebates in order to get that $200 in value for the inquiry.

Instead, here’s where I ended up…

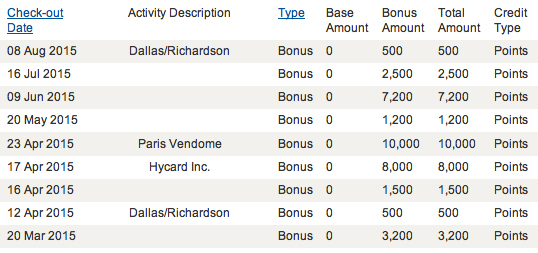

Excluding the April 17th transaction (which was actually a transfer of points from Ultimate Rewards), these were all 20% rebates on stays I made at Hyatts between March 1st and July 31st. Add them together and you get 26,600 points in rebates.

That’s nearly $400 in extra value for the credit inquiry. Nearly double what I’d hoped.

I didn’t go out of my way to stay at Hyatts because of the rebate, nor did I have more travel than usual (though clearly I did have a number of hotel nights in the last 6 months). But I’ve been trying to requalify as a Hyatt Diamond for 2016, which means I’ve booked stays with Hyatt whenever it’s convenient and makes sense. That doesn’t mean every single stay was at a Hyatt, but since I get all the benefits of Diamond status, I’ve been choosing Hyatt whenever I can over other options.

So why was I so wrong?

If I knew I was going to be staying at plenty of Hyatts, why didn’t I think the rebate would be worth much?

Simple. In my original column, I noted you’d have to redeem nearly 67,000 Hyatt points in order to get $200 in rebate value. That sounds like a lot (and yes, I went out of my way to make it sound that way).

But in practice, it isn’t really that much. Two nights at a Category 6 property comes to 50,000 points alone. Five nights at a Category 3 hotel is 60,000. So really, it might only take 2 stays to make the rebate worth getting the card.

Also, 20% doesn’t sound like a lot, but when you’re booking Points + Cash nights and getting both the rebate and additional points for the cash portion, things start to add up quickly. That two night 15,000 Points + Cash stay at a Category 3 property with the $200 cash co-pay, the 20% rebate, and the 35% Diamond bonus puts nearly 1/3rd of the points back in your account once your stay is over. After just 4 or 5 stays, you’re already well over $300 in earned and rebated points.

The Devil’s Advocate admits he underestimated the value of the Hyatt rebate.

Numbers don’t lie, but sometimes they can look bigger than they are. I was fooled into thinking that the redemptions needed to make this rebate worth doing were unreasonably big. But after actually doing the stays, I’ve realized they were actually surprisingly reasonable.

I don’t know if Hyatt was pleased or not with the results of this rebate promotion, but given how popular it was, there’s certainly a chance they’ll do it again at some point in the future. Obviously, if you’re not a Hyatt customer and Hyatt properties don’t fit into your travel profile, then a rebate like this wouldn’t be worth chasing no matter what the numbers look like. But if you do and this rebate (or one like it) pops up again in the future, you might consider whether a Chase Hyatt Visa is worth picking up.

And don’t let a not-always-right writer try and tell you otherwise.

Devil’s Advocate is a bi-weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by following him on Twitter @dvlsadvcate or sending an e-mail to dvlsadvcate@gmail.com.Recent Posts by the Devil’s Advocate:

- It Lives! Amex Platinum Reimbursements For Gift Cards Lives!

- Why Are Points and Miles Better Than Cashback?

- Is The Amex Platinum $200 Credit Truly Dead For Gift Cards?

Find the entire collection of Devil’s Advocate posts here.