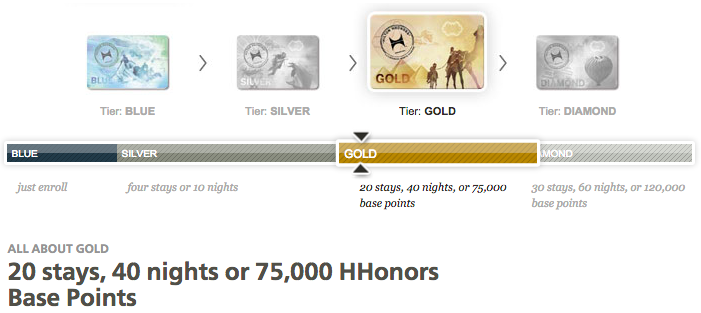

Hilton HHonors is a good loyalty program for some travelers who want to enjoy the benefits of elite status but don’t think they’ll stay often enough to earn it the old fashioned way. For many years it has offered “free” Gold status as a benefit to people with a variety of credit cards. Most of these were branded with Hilton’s name (e.g., the Citi Hilton HHonors Reserve) but now you can also get Hilton Gold status with the American Express Platinum Card.

Hilton HHonors Gold status entitles guests to free continental breakfast, a possible room upgrade, and 25% bonus points. You’ll also get the fifth night free when you book a long award stay.

The Platinum Card has a place in many travelers’ wallets despite the hefty $450 annual fee (and there are some options to waive the fee entirely, if you have certain investment accounts). Most significant among these is the $200 annual airline fee credit. Cardmembers can select an airline at the beginning of the year and get reimbursed for up to $200 of eligible small charges.

Worth noting is that the fee credit is provided once per calendar year, but the annual fee is charged on a 365-day basis, so you could apply now and get two annual fee credits (total of $400) while paying only the first year’s annual fee.

Other benefits and discounts of the Platinum Card include:

- $100 reimbursement for Global Entry or TSA PreCheck application.

- Access to American Express Centurion Lounges, including five locations in the U.S.

- Access to Delta Sky Clubs when traveling with Delta.

- Access to a variety of other lounges, including Alaska Board Rooms, when traveling on any airline. (You’ll need to request a free Priority Pass membership card).

- Receive free breakfast, resort credits, and occasional free nights when booking select properties through Fine Hotels & Resorts.

- In addition to Hilton, you can also request Gold status with Starwood Preferred Guest.

- Discounts and elite status with National, Hertz, and Avis car rental agencies.

My wife and I have been Platinum cardmembers for over three years. Each year I wonder if it’s worth paying the annual fee, and each year I do the math and decide it works out. We really do get a lot of benefits from it — but every person’s travel habits are different. For example, we live in Seattle and transit Dallas often, so we visit the Board Room and the Centurion Lounge. We’ve been able to take advantage of all of the card benefits at some point.

Currently American Express is offering targeted offers for 40,000, 60,000, or 100,000 Membership Rewards points if you spend $3,000 in the first three months. I don’t recommend the Platinum Card as a good option for daily spend since all purchases earn just 1 point per dollar, but to get the bonus I think it would be worth using the card for a few months and then enjoy the benefits.